02 Jul Industry Data: How to Answer the Questions You Didn’t Know to Ask

BY TOBY SWOPE, D+R INTERNATIONAL

BY TOBY SWOPE, D+R INTERNATIONAL

Over the past decade, “Big Data” has been hailed as the miracle cure for businesses of all types. Now, thanks to years of focus and investment, businesses have access to exponentially more raw data than ever before – sales data, product data, customer data, and more. But beyond the buzzwords, business owners are wondering how much of that data is useful to the bottom line, how they can use it to get the insights they need, and, most importantly, how their data compares to the competition.

At D+R, we help industries consolidate, aggregate, harmonize, and anonymize their data to mine the messiness for insights and value. I’ve seen the good, the bad, and the ugly, so to speak (and trust me when I say there’s a lot of ugly data out there). So why is data important from an industry perspective?

The simple answer: with the right industry data, you can answer the questions you didn’t even know you wanted to ask.

Are you only looking at your own data?

As a first step, you can start with your own internal data. Learning to run business analytics is a must. But if you don’t have benchmarking data to back that up, can you be sure what’s happening to you is happening industry wide?

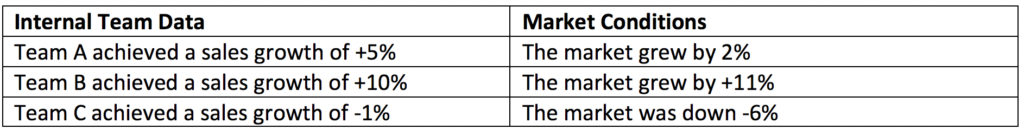

Say you need to distribute bonuses to your sales team. Consider this scenario:

Who should get the highest bonus? If you base your decision solely on internal data, you’d think Team B did an amazing job. But you’d be wrong. Team C actually outperformed the market by 5%. But you would only know that if you could benchmark against the whole market.

Do you really know what is going on in your industry?

Once upon a time, you could conduct a straw poll at an annual conference and come away with a picture of the market close enough to work. In this age of supply chain optimization, industry consolidation, and the ever-encroaching online-sales elephants, those straw polls don’t work. Competition is fiercer than ever and having only a high-level view won’t cut it anymore.

Many industries use annual national surveys for benchmarking, but those too can obscure important parts of the picture. Did your whole region outperform the national market, or was that just you? Should you stock more of that new niche product next quarter, or is demand seasonal?

Are you ready to answer the next set of questions?

Inevitably, within almost every industry I’ve worked, there are questions where the answers rely on having market information from five years ago. The trouble is, it’s hard to go back in time. Digging up old information means digging into old POS systems and archived servers—which is no fun at all.

So, don’t wait. Collect all the information you can, and do it now. Because in five years, when you realize you can answer that question you didn’t know you had, you’ll be glad you did.